Statistics tasks

An analytician is studying the profits of a company over the course of ten years. Let X be the number of years after the inital year the analytician is studying. Y is the profits in year X and the analytician believes the profits are a normal distribution stochastic(random) variable with expectation 𝐸(𝑌)=𝛽0+𝛽1𝑥 and standard deviation 𝜎=0.08. Based on these observations the analytician finds that:

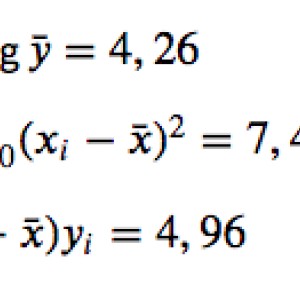

𝑥¯=3.6 and 𝑦¯=4.26

𝑀=∑^9_𝑖=0 (𝑥𝑖−𝑥¯)^2=7.44,

∑^9_𝑖=0 (𝑥𝑖−𝑥¯)𝑦𝑖=4.96

(I added this as a picture too as I have a hard time writing formulas on here)

Questions:

1. Estimate 𝛽0 og 𝛽1.

2. Can it be proven that the yearly increase in profits, 𝛽1, is bigger than 0.5? Formulate fitting hypothesis and do a hypothesis test at 0,5% significance level.

Critical value=

H1 or not H1?

3.Find a 99% confidence interval for expected profits for x=5

Upper confidence limit:

Lower confidence limit:

4. Find a 95% prediction interval for expected profits for x=1

Upper prediction limit:

Lower prediction limit:

Answer

- The questioner was satisfied with and accepted the answer, or

- The answer was evaluated as being 100% correct by the judge.

- answered

- 1648 views

- $5.41

Related Questions

- Equation Required/Formula

- Statisitical Experimental Design Question

- Sample size calculation - single mean method

- Explain how to get the vertical values when $n = 10$, $p = .5$, $\mu = 5$ and $\sigma^2 = 2.5$

- Compute the cumulative density function of X

- How to use bootstrap techniques to criticise a linear model?

- Introductory statistics, probability (standard distribution, binomial distribution)

- How do I meaningfully display Kruskal Wallis Data when I have a lot of zeroes?